PROJECT OVERVIEW

The project aimed to redesign the Admin Credit Portal Dashboard into an Agentic AI-powered system for internal employees who oversee credit, distributor, and retailer management. The focus was on reducing manual work, improving visibility, and enabling faster, data-driven decision-making.

TARGET AUDIENCE: Internal employees, specifically team leads who monitor overall credit health and distributor-retailer transactions.

PRESENT FLOW: Current Way of Working

Before introducing Agentic AI, the admin workflow looked like this:

-

Manual invoice updates for each retailer and distributor.

-

Bulk uploads for settlements and credit limit changes.

-

Time-consuming checks of overdue amounts and pending settlements.

-

Limited dashboard insights (static reporting only).

This process was slow, error-prone, and heavily dependent on manual effort.

PROBLEM STATEMENT

The current credit dashboard lacks scalability and efficiency, overloading admins with repetitive manual tasks and reactive insights. Bulk upload failures and the absence of intelligent forecasting or automated collections further slow down the entire credit management process.

CHALLENGES

-

Heavy reliance on admin inputs.

-

Delayed settlements and missed credit risks.

-

Limited foresight into distributor/retailer payment behaviors.

-

Inflexible bulk upload workflows.

-

Growing data volume with limited capacity to process quickly.

WHY CHANGE MATTERS

If Payyz continues with the existing approach:

-

Settlements will remain delayed.

-

Missed risks could impact financial stability.

-

Employees may face burnout due to workload.

-

Leadership visibility into distributor-retailer dynamics will stay limited.

How might we empower the Admin Credit Portal to intelligently monitor, predict, and act on credit risks—reducing manual effort, accelerating settlements, and enabling faster, smarter financial decisions through AI?

FROM DATA to DECISION: : The Agentic AI Advantage

🔹 Credit Risk Monitoring Agent

Flags risky accounts before they default.Monitors distributor/retailer credit health in real time.

🔹 Order Optimization Agent

Suggests optimized order patterns based on payment history.Helps reduce risk by balancing order volume with credit standing.

🔹 Insight & Forecasting Agent

Provides predictive insights on overdue trends.Recommends adjustments to credit limits based on future behavior.

🔹 Collections Assistant Agent

Automates reminders and settlement nudges.Simplifies collections with intelligent follow-ups.

VISUAL DESIGN

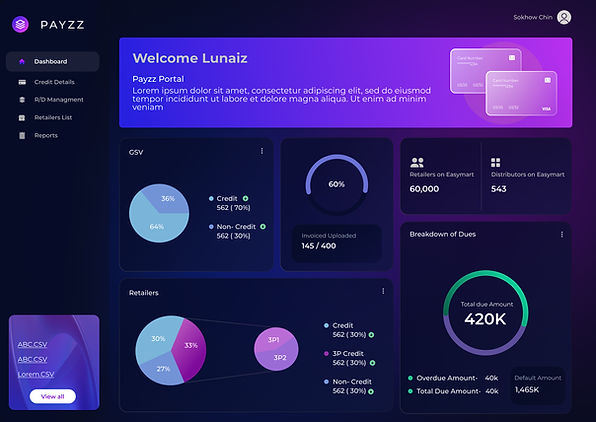

Dashboard

A unified control center giving admins real-time visibility into transactions, credit usage — all in one view.

An integrated workspace where admins can manage retailer and distributor data while Agentic AI agents run in the background — analyzing patterns, updating records, and surfacing smart insights instantly.

R/D management

Dashboard

Intelligent agents continuously analyze data, identify anomalies, and update the dashboard with proactive insights and recommendations

A streamlined process where admins upload bulk data for agents to process automatically, reducing manual effort and ensuring faster, more accurate updates

Upload management

70%

Reduction in manual updates by admins.

Proactive alerts

Improved risk management.

Faster

Settlements with AI-driven automation

Scalable

Design that grows with the business and its evolving user network.